Three years since the ICO boom, the token economy is littered with projects struggling to ensure their native currency retains value. Many are turning to the traditional startup playbook, building an agile team to find and fill market demand. Perhaps it's pressure from venture investors or a lack of exposure to other strategies, but the conflation of cryptonetworks and corporations is at an all-time high.

Satoshi would be rolling in his grave. The projects with the greatest value and utility today—i.e. Bitcoin, Ethereum, and a few other products of the ICO era—did not follow the traditional product development trajectory at all. These success stories started with the open source ethos and underwent a different journey: they began with a broad distribution of tokens, followed by permissionless product innovation which activated them in useful ways.

In Headless Brands, we called this market-product fit, a dynamic in which token holders generate many competing narratives and use cases, which they explore simultaneously. From our last essay:

To update our terminology, market-protocol fit is the most accurate language for this phenomenon. By distinguishing this market-first pattern from the startup playbook, we can clarify our thinking about the token protocol life cycle and understand how far projects have progressed.

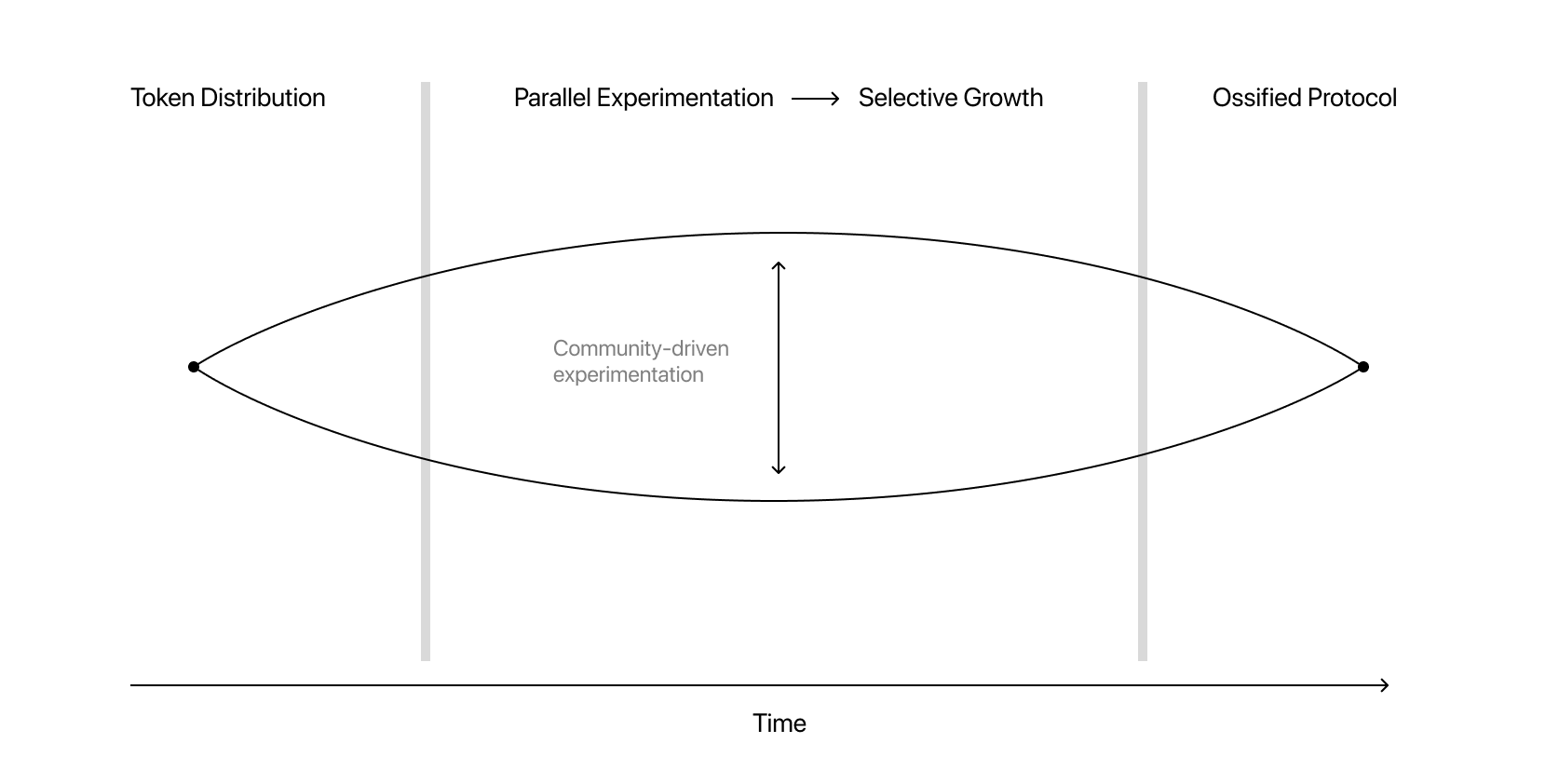

Market-protocol fit can be divided into 3 conceptually distinct phases:

- Promise distribution - A compelling idea is sold within a minimally codified open market framework.

- Utility discovery - Early community members prototype new uses cases, some of which provide real utility, driving growth.

- Ossification - Network effects strengthen value and push the protocol to converge around specific functionality and narrative.

The entire process can be visualized as a football-shaped curve which begins with an initial token distribution event and ends with protocol ossification. The curve width corresponds to narrative variation and experimentation with unique use cases.

Marc Andreessen's original formulation of product-market fit describes how startups move from minimum viable product to serving customers. Cryptonetworks instead start with nothing, apart from token-based incentives and narratives, mobilizing developers and contributors to spontaneously coordinate in ways that end-users will ultimately find beneficial.

Only a handful of projects have successfully bootstrapped themselves in this way, many others are still early in this challenging process. In this essay we describe the key phases of market-protocol fit, characterizing the changes that tokens and their underlying blockchains introduce to the innovation life-cycle.

Minimum Viable Promise

At inception, tokens are neither digital stores of value, nor equities—they are simply promises that attract an audience.

Though seemingly counter to the ethos of trust minimization, simple, trustful promises have played an essential role in the formation of the cryptocurrency industry. Recall that on launch, Bitcoin was merely the promise of transacting digitally without third-party intermediation. It was not yet money as it had no exchange value.

The essence of a token's promise is that one day it will have actual utility. The challenge for promise-issuing teams is to remove themselves as early as possible, letting the community fulfill this promise—and thereby achieving "sufficient decentralization" from a regulatory perspective.

Successful fulfillment requires the build-out of additional contexts—exchanges, wallets, media, and projects "composed" on top—which make use of the token and make it useful by realizing its capabilities and value.

However, at early stages, the notional value of tokens is determined almost entirely by narrative rather than utility. The zeitgeist of an incipient token can be understood as a kind of decentralized branding, whereby permissionless narrative formation is driven by speculative desire. Whether financial, social, or owing to a genuine affiliation with the world a token proposes, desire is the animating force that drives initial adoption and a flourishing of supporting narratives.

Projects that never move beyond narrative value are cases of "marketing as proof of work," in which conspicuous spending signals the intention of continued investment. For those that do, their initial promise acts as a Schelling point for the community to build toward, kicking off a process of headless branding and infrastructure development. In either case, projects begin with the circulation of "potential value" rather than bringing a real product to market.

It's important to understand why even the most grandiose promises are "investable" at this stage (if inadvisable under US securities law). Tokens are issued on a blockchain, which creates, at minimum, the conditions for exchange, ownership and participation, as well as more advanced rules like scarcity of supply, consensus, reward mechanisms, and fee structures. Here, law is code: the normative dimension of the protocol stabilizes our behaviors and assumptions around how exchange occurs and tokens can be used. This means we can own and exchange tokens on the basis of justifiably subjective valuations, knowing what they represent without them having a use case yet.

A question that keeps me up at night:

— Eric Wall 🌈 (@ercwl) February 13, 2020

Is it possible to create a rubbish coin based on advanced bullshit, build a community of misguided fans nevertheless, run it centralized for 5 yrs, hardfork-copy the design of a real working project, keep the community and become a success? https://t.co/L9QdGYBbyy

In essence, fake-it-till-you-make-it is the attitude required by early-stage crypto projects to bootstrap themselves beyond the promise phase. Of course, some tokens remain purely speculative, fads that fall into obscurity before becoming culturally embedded. But with a strong community of believers, a token can establish a virtuous cycle between headless brands and infrastructural build-out to progressively realize its initial promise.

In short, cryptographic tokens need only a blockchain, a compelling promise, and wide distribution to begin manifesting value in people’s minds. The capacity to capture desire and imagination enables a minimal market framework to grow beyond this promissory phase—a process we term utility discovery.

Utility Discovery

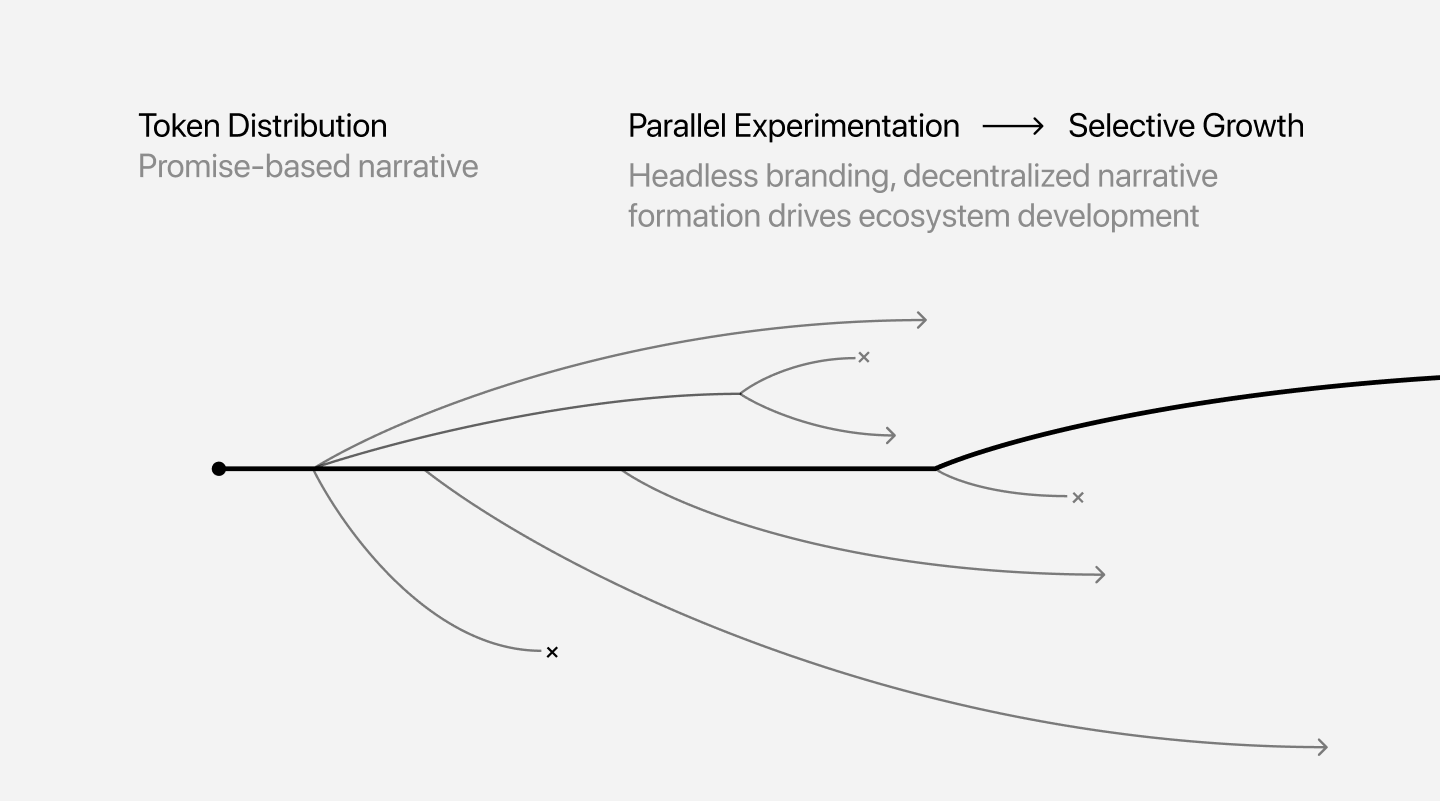

In the world of retail products and services, most exchange traditionally begins with an ask, followed by an expectation that some utility will be provided. In crypto, however, we see the reverse: mass issuance of a fractional promise, the utility of which is not fully defined at the outset, but progressively realized. This realization unfolds in two steps:

- Many teams experiment in parallel with products and services built around a promissory token protocol, generating a surplus of new infrastructure.

- Early adopters drive the growth of specific products and services, where network effects take hold and push the underlying protocol to optimize toward scoped functionality.

Parallel Experimentation

Utility discovery begins by mobilizing a community of early adopters on the basis of the promises a token represents. Money is a social phenomenon, and tokens with a participatory dimension give community members a way to start exploring this sociality before the protocol gains mainstream adoption. For early Bitcoiners, this involved contributing to the codebase, participating in discussions on the Cypherpunk Mailing List, IRC, or bitcointalk, buying alpaca socks, or just holding Bitcoin and espousing the virtues of Austrian economics. Alternatively, many experimented with Bitcoin by forking the protocol and launching an entirely new currency.

Likewise, Ethereum’s early promise of letting anyone mint their own token was a crucial spark that kicked off parallel experimentation. This ultimately led to rampant speculation via ICOs, but it also enabled differing visions to coexist within a single ecosystem and reinforced the narrative of Ethereum as a crowdfunding platform that fostered experiments with new protocol features and standards.

On-chain governance mechanisms also provide an avenue for early community experimentation. For instance, Decred and Tezos have yet to find a killer app to fuel their internal economies, but formalized governance models and wide token distributions enable token holders to feel connected to these projects and engaged in continued experimentation. On-chain governance also has the advantage of a lower technical barrier to participate in impactful ways, allowing holders a greater sense of ownership over the future direction of the project. The Zcash community's recent move to integrate a formalized governance process as part of Network Upgrade 4 confirms this tendency.

Experimentation is also sustained through a variety of in-person events, hackathons, developer conferences, meetups, and summits, as well as online meeting spaces, forums and chat platforms, where community members exchange ideas, co-create, and cultivate new narratives together. Importantly, even if most experimental output never goes beyond a forum post or prototype, the generation of novel ideas, internalization of learnings, and wide sense of forward momentum are still crucial to the success of future initiatives.

Selective Growth

As products and services emerge from this nascent stage, capital and resources are locked into the underlying token ecosystem. The more value dedicated to a protocol, the more liquid and reliable it becomes. Eventually, others can assume certain base functional characteristics and issue their own promises on top, relying on the existence of a stable underlying infrastructure to create incipient "utility verticals."

Not all promises will be compelling, and not all experiments will be viable—in fact most won't. But the 1% with real utility will attract attention, energy, and investment, driving a flywheel of adoption, liquidity, and feedback from the community.

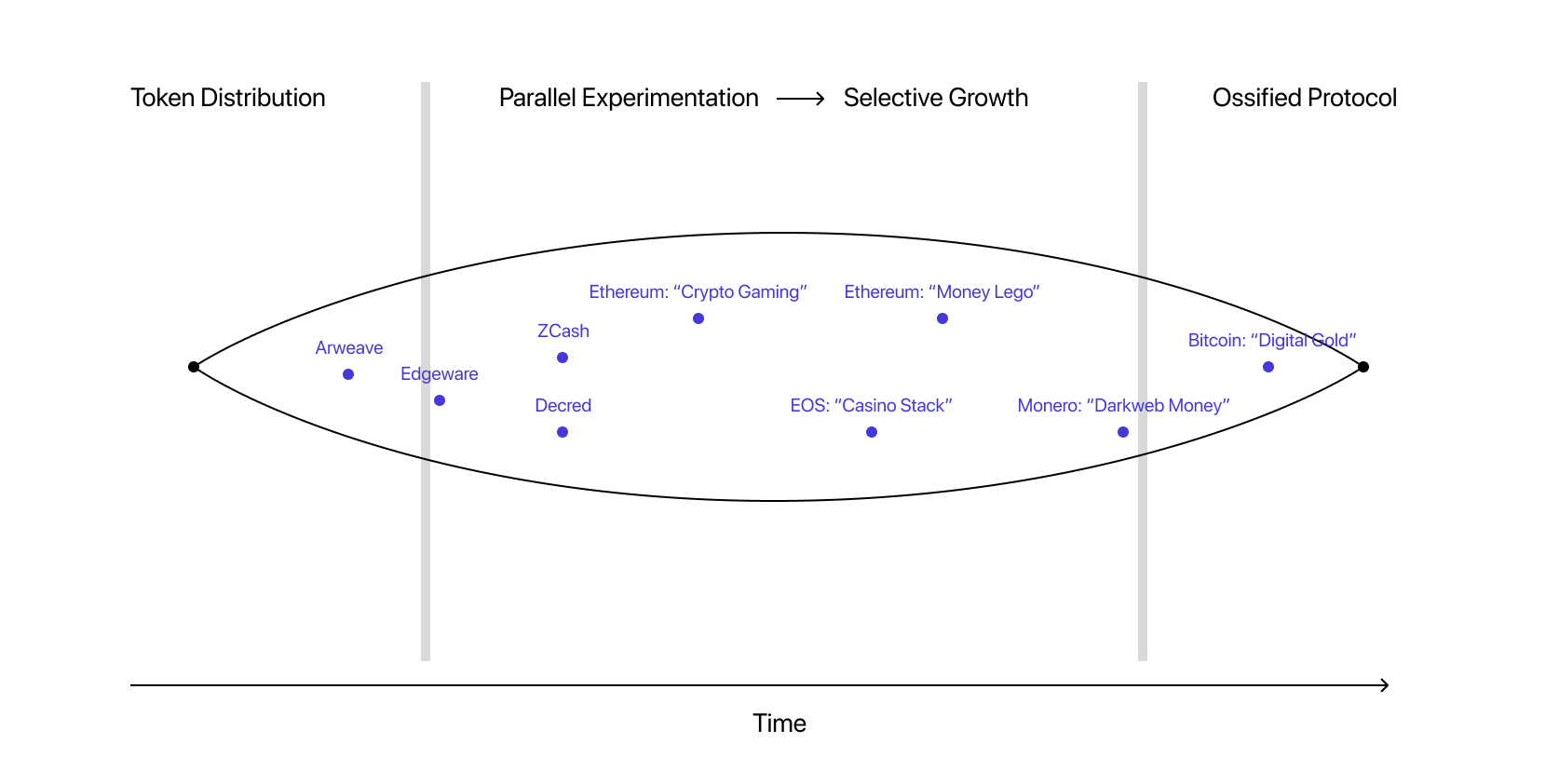

We see Ethereum today in the middle of its own utility discovery process, having activated a strong and varied community iterating through narratives and use cases—from gaming, to finance, to DAOs. For Ethereum, it was the early promise of a "world computer" that originally attracted developers. But as more people joined the network and started experimenting with its programmable state, they invented use cases such as stablecoins, lending protocols and automated market makers, shifting the Ethereum narrative from "global computer" to "money lego," meanwhile contributing to the development of more composable infrastructure.

Maker and the plethora of DeFi protocols that have followed are playing a key role in driving a process of selective growth in the Ethereum ecosystem. They do so through collateralization and various staking and burning mechanisms, quite literally locking-in the promise of "programmable money" while controlling token supply, creating tangible network effects that realize an increasingly mature stack.

Crypto-based gaming is another nascent utility vertical on Ethereum. Here, the relevant headless brand has more to do with "true digital ownership" of assets, a story that was closely tied to the invention of non-fungible tokens. Sidechains are a key L2 technology that enable gaming as a viable use case by facilitating faster transaction speeds and contributing to lock value in the underlying protocol. At the user layer, games like My Crypto Heroes and Gods Unchained have already developed large player communities. Trading card games are powerful mechanisms for accepting and retaining capital within the ecosystem, encouraging more trading venues to support them and thereby expanding the user base who can play with one another—a classic example of the flywheel.

Ossifying the Brand

Promises set out in the whitepaper are not always the ones the market ultimately converges upon. Instead, headless branding and product development take place simultaneously in a frenzy that generates branching narratives and desires.

A strong narrative is backed up by a functional protocol, and it makes any product developed on top more compelling. As more resource lock-in occurs and the stack solidifies, the associated narrative becomes the defining story of a given protocol ecosystem.

In Layers (not eras) of blockchain computing, Jesse Walden writes that the "development of more advanced technologies does not necessarily eat the use cases of lower layers, but instead results in a complex, specialized stack." It's this completed stack and its narrative by which we come to know the entire ecosystem.

Reaching market-protocol fit is a journey of forking paths and complex, political upgrades. Bitcoin shed several narratives before arriving at the censorship-resistant store of value, "digital gold" narrative. This took place over years, alongside the development of supporting mining and financial infrastructure, and an ideological fork that pushed out incongruous narratives.

Ethereum is facing similar challenges in its negotiation between the base layer roadmap and needs of Layer 2 protocols. It's still unclear whether Ethereum 2.0 will break one of DeFi's core value propositions, composability, or whether it could successfully reinvent itself without this narrative.

Meanwhile, on EOS, a gambling vertical is emerging among its community of Lambo enthusiasts. Zcash and Decred are still in a messy utility discovery phase, and more recently launched projects such as Arweave and Edgeware have barely moved beyond their initial promise.

Conclusion: Headless Strategy

Like headless brands, market-protocol fit is an art of coordination, requiring the participation of disparate stakeholders. Where headless brands drive consensus around a narrative, market-protocol fit is the process of advancing a set of infrastructure in accordance with that narrative, providing a minimally consistent substrate to continue building upon.

Market-protocol fit is concerned primarily with narrative buy-in, infrastructural build-out, liquidity, and operational expenditure. Once the initial promise has been widely distributed, community and capital are all that matter to propel the expansion of a token ecosystem. While paths to "fitness" will vary with a project's initial direction and community, we can find common patterns in the strategies projects are employing to navigate the phases we've discussed.

- Promises must be compelling, with meaningful stake distributed broadly and fairly to those with whom the promise resonates. This means improving upon and re-imagining the "fair distribution" problem. Over the last few years, airdrops alone have been proven ineffectual to activate a community. Other (headless) strategies need to be in place to channel speculative desire into a protocol—expressed as developer mind share, mining/staking resources, participation in forum debates, meme making, etc.

- Stakeholders must be empowered to experiment and discover meaningful utility. This means formalized support of experiments, and incentives that favor HODLing over speculative selloffs. At this stage, governance and staking can be powerful tools to channel the energy of the community into projects and strengthen the claim that the promise will be fulfilled. Both need to be carefully deployed, so as not to stifle the diversity of initiatives and discourse. Furthermore, there must be strong narratives that spur experimentation and advance ecosystem build-out. Governance and staking are only effective if their purpose is closely coupled to advancing the promise of these networks; their function is to enable people to signal belief—and invest—in a future where they want to inhabit.

- A feedback mechanism must exist to funnel resources and liquidity into promising experiments. Mechanisms for resource staking and collateralization help compound network effects that advance the development of the ecosystem stack. This also means that large stakeholders, particularly investors, must be willing to supply follow-on support as a protocol grows. This already partially occurs through investment strategies such as generalized mining aimed to sustain the supply side of a protocol's internal economy; new initiatives directed at supporting headless development, without overtaking it, and fostering adoption could also prove beneficial to advance toward ossification.

Market-protocol fit is a new phenomenon in the life cycle of technological development where open source code endogenously defines the conditions of exchange, ownership, and stakeholders can permissionlessly participate from the outset.

Market-protocol fit and product-market fit are both competitive dynamics that progressively drive toward a better match between market participants and some functional utility. In this sense, we see market-protocol fit-based strategies as complementary to other approaches, such as progressive decentralization.

Tokens that represent promises are vessels that can accept financial capital, but also attention, skills, ethos, and imagination. Locking value and "values" into a new techno-economic system creates the conditions for headless brands to emerge. From there, it's up to projects to cultivate their memetic potential and activate token holders to build towards a flourishing ecosystem.

©2024 Other Internet Research Institute